will the irs forgive my debt

Believe it or not credit card companies may be open to forgiving or negotiating your balances. Lets look at a couple of options you should be aware of.

Some Unhappy Students Don T Want To Pay Back Loans So They Don T Tax Debt Payday Loans Student Loan Debt

If you receive a 1099-C you may have to report the amount shown as taxable income on.

. An offer in compromise allows you to settle your tax debt for less than the full amount you owe. Basically you offer to pay a portion of your taxes now and the IRS agrees to forgive the remaining debt. In these situations the lender often has to forgive a portion of the debt as part of the settlement or restructuring.

You can reach them at. Credit card debt forgiveness is not a magic pill and may come with some pretty serious risks attached. If you dont qualify for an online payment plan you may also request an installment agreement IA by submitting Form 9465 PDF Installment Agreement Request with the IRS.

Nelnet did not immediately respond to Insiders request for comment. To Whom it May Concern. But are you sensing a theme here.

A lender that cancels or forgives a debt of 600 or more must send Form 1099-C to the IRS and the borrower. Get the latest updates on COVID-19 debt relief. Internal Revenue Service Complete the address as stated on your tax penalty notice Re.

Senders Address Date. You settle a debt with a creditor who agrees to forgive 8500. Call our Debt Management Center at 800-827-0648 or 1-612-713-6415 from overseas Monday through Friday 730 am.

You do not have to report any of that money as income on your tax return. We owe what we owe. Were still paying off the debt of Lincoln because there have been no steps yet to balance a budget and decrease our debt to 0.

Or contact us online through Ask. If the IRS approves your IA a setup fee may apply depending on your income. I am writing to request an abatement of penalties in the amount of _____ as stated in the notice for the _____ tax penalty I received from the IRS dated _____.

There are strict eligibility. The debt is what the government has been borrowing for overspending. IRS Collection Enforcement Actions.

BDAR is only for Federal student loans so youd need to look into alternative options for handling your private debt. My favorite option is going after a debt settlement and using McCarthy Law PLC to handle negotiations on your behalf. Your assets are worth 35000 and your debts still total 45000 but the creditor writes off a 14000 debt.

For debt related to VA benefits. Determine whether it is business or non-business bad debt. If you cannot pay the amount in full you can request a payment plan see below.

Adjusting for inflation has no. It is in your best interest to contact the IRS and make arrangements to pay the tax due. You may designate payments to a specific tax year and tax debt IRS may file a Notice of Federal Tax Lien.

202 - Tax Payment Options. Credit card debt. With the pandemic pause on student-loan payments.

Refer to Tax Topic No. If someone had 2000000 in debt in 1993 they would still owe 2000000 interest. Request for Penalty Abatement.

President Joe Biden is inching toward a decision on student-loan relief and multiple reports have suggested the relief will be close to his 10000 debt-forgiveness campaign pledge and potentially targeted to those making under 125000 a year. Apply With the New Form 656 If you apply for an offer in compromise April 25 or later you must use the April 2022 versio. Learning how to account for debt forgiveness will allow you to confidently keep the books up to date in the event of a default or debt settlement.

Irs Tax Debt Forgiveness Paladini Law

Irs Increases Standard Mileage Rates For 2013 Debt Relief Programs Internal Revenue Service Irs

Many Americans Will Receive 1 200 Payments From The Irs And Many Have Questions About The Motley Fool Debt Money

Irs Forms 1099 Are Critical And Due Early In 2017 Tax Forms Irs Forms 1099 Tax Form

Tax Debt Settlement Everything You Must Know On Irs Tax Settlement Firms Blog

Epub Free Lower Your Taxes Big Time 20192020 Small Business Wealth Building And Tax Reduction Secrets F Tax Reduction Small Business Tax Mcgraw Hill Education

Tax Debt Relief Programs Help Reduce Debt Yet Few Have Applied For Relief Fresh Start Information Tax Debt Tax Debt Relief Debt Relief Programs

Irs Tax Debt Forgiveness Tax Debt Debt Forgiveness Tax Debt Relief

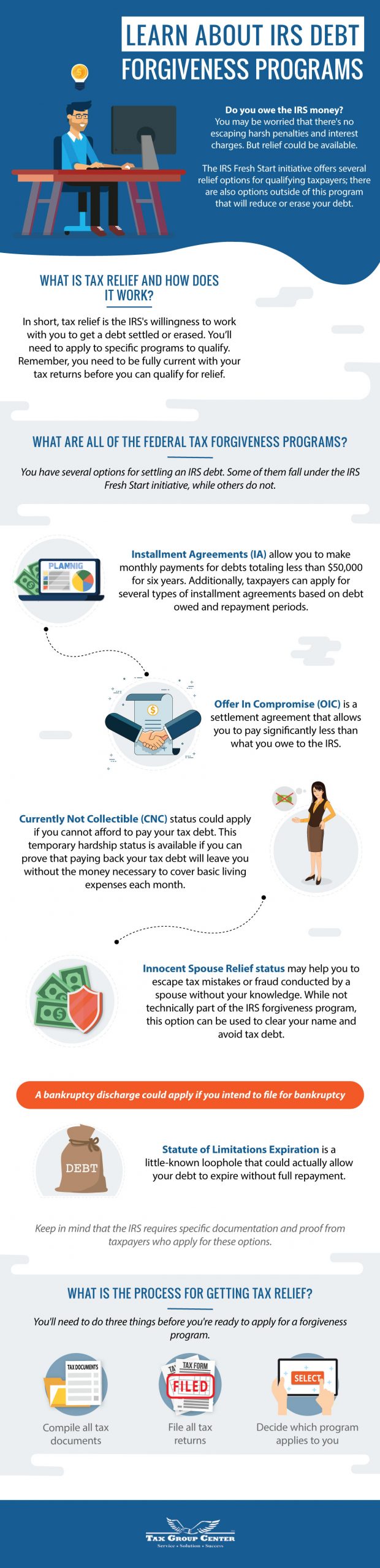

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Pin By Sally Ball On Creatives Tax Debt Irs Taxes Forgiveness

How To Request For An Irs Hardship Payment Extension Irs Credit Card Statement Tax Help

Tax Debt Forgiveness Frequently Asked Questions Tax Relief Center Debt Forgiveness Tax Debt Debt

Examples Of Debt Settlement Letters Www Yourdebtsettlementattorneys Com Debt Settlement Debt Consolidation Letters

Tax Debt What To Do If You Owe Back Taxes To The Irs Tax Debt Owe Taxes Transfer Credit Card Debt

Tax Debt Relief Things You Need To Know Tax Relief Center Tax Debt Relief Tax Debt Debt Relief

What Is A 1099 Form And How Do I Fill It Out Bench Accounting Tax Forms Irs Forms 1099 Tax Form